INTRODUCTION

The financial year ended March 31, 2020 will be marked as an unprecedented year with the novel coronavirus (COVID-19) being declared by the World Health Organisation as a pandemic on March 11, 2020. Besides the toll that this outbreak has had on human life, it has also disrupted the social, economic and financial structures of the entire world. As a result, bond, stock, currency and commodity markets have been in a tailspin, witnessing extreme volatility. Many businesses have been forced to a grinding halt, supply chains have been severely disrupted and job losses continue to mount.

In April 2020, the International Monetary Fund (IMF) stated that in the year 2020, the global economy will experience its worst recession since the Great Depression. Across the globe, governments and central banks are undertaking unconventional policies with the primary objective of saving lives and livelihoods. The full impact of the so-called “Great Lockdown” at this juncture is difficult to predict, but recovery is likely to be long and painful.

In India, from March 25, 2020 onwards, the central government declared a national lockdown, restricting the movement of the entire population of the country as a preventive measure against the spread of COVID-19. Post May 18, 2020, which marked the fourth extension in the date of the national lockdown, there has been some easing of restrictions outside of the containment zones.

The focus of this Management Discussion and Analysis Report is to analyse the performance of the Corporation during the period April 1, 2019 to March 31, 2020 (FY20). While the impact of COVID-19 in India played out towards the fag end of the financial year, given its materiality, this report also assesses post COVID-19 developments and its impact on the Corporation.

MACROECONOMIC OVERVIEW AND INDUSTRY DEVELOPMENTS

Global Macroeconomic Overview

For a large part of FY20, the global macro-economic landscape was dominated by uncertainties arising from increased trade tensions, delays on Brexit, oil market disruptions and geopolitical risks, which combined together, led to a deceleration of global growth. Lower interest rates and easy monetary policies of major global central banks boosted leverage. As a result, indebtedness of emerging markets at the government and household level showed an uptrend. Global stock markets stayed volatile largely as sentiment kept changing depending on the unfolding events around US-China tariff actions. Yet, the year under review saw global stock markets touch record highs.

By February 2020, the global economy began to feel the impact of COVID-19 disruptions. As the health, economic and financial crises morphed into each other, the IMF projected global growth in calendar year 2020 to contract by 3%. This was based on the assumption that the pandemic would fade by the second half of 2020.

Indian Macroeconomic Overview

Successive quarters in FY20 has seen India’s GDP growth slide down. GDP growth for FY20 is estimated at sub 5% as against 6.1% in the previous year. What started out as an investment led slowdown slowly broadened into a weakening of consumption as well. Increased financial stress amongst rural households, sluggish manufacturing sector, lack of growth in new job creation and risk averseness in lending, especially to the micro, small and medium scale enterprises were some of the reasons for the overall slowdown in the economy.

A large part of financing, particularly niche and retail lending in India is done by non-banking financial companies (NBFCs). However, with a large number of NBFCs’ access to credit getting squeezed as banks and mutual funds became more wary of lending to the sector, credit growth began to wane as well. Lending to the NBFC sector remained largely restricted to the higher rated entities.

Yet, the broader macro fundamentals of the Indian economy remained intact. India’s forex reserves as at March 31, 2020 stood at US$ 476 billion, sufficient to cover over a year’s imports, the current account deficit is likely to be under 1% of GDP, the average inflation rate for FY20 remained within the Reserve Bank of India’s (RBI) comfort zone and lower global oil prices benefitted India as the country imports over 80% of its crude oil requirements.

India is a domestic consumption driven economy. Based on the IMF’s initial assessment of the impact of COVID-19, India would be the fastest growing economy amongst G-20 countries in 2020, with a projected GDP growth of 1.9%. Other estimates of GDP growth for India are pegged lower or even forecast a contraction. The forecasts vary widely depending on assumptions made based on the extent and duration of the lockdown.

In response to the COVID-19 crisis, the Indian government, despite its extant constraints on fiscal finances, announced a wide-sweeping stimulus package ranging from humanitarian measures such as distribution of food and direct benefit transfers to the most vulnerable segments of society, sector specific measures for businesses sharply impacted by the lockdown, guarantee schemes, tax concessions and a slew of policy measures and structural reforms to help revive economic growth and improve the ease of doing business in India.

Housing and Real Estate Markets

Given the shortage of housing, the demand for affordable residential homes in FY20 continued to remain strong. During the year, new launches of residential units which received favourable response from homebuyers largely met four key criteria -- 1) reputed developer with a strong past track record of delivery; 2) projects with financial closure through stable financial partners; 3) right sized units; and 4) right priced units which was affordable by end users.

The demand for high end luxury residential housing remained subdued. A key hindrance for the real estate sector has been the overhang of unsold inventory. According to JLL India, across the top 7 cities, the unsold inventory was estimated to be worth over ` 3.7 lac crore as at March 31, 2020.

The Indian commercial real estate sector has attracted considerable interest from large foreign private equity investors in the recent period and continued to do so during the year under review. Demand for grade A commercial real estate was mainly from banking, financial services and insurance, IT & IT-enabled services, e-commerce and other professional services. With the logistics and warehousing sector getting more organised and tech enabled, this segment too gained traction.

During the year, many developers were under increased financial strain in an environment that had become more risk averse in lending. Several developers were over leveraged and with insufficient cashflows owing to lack of sales and high unsold inventories, the difficulties got compounded.

The lockdown due to COVID-19 resulted in the construction sector coming to a grinding halt. The most vulnerable segment has been the migrant labourers who are daily wage earners. Migrant workers comprise 80% of the 55 million workforce in the construction sector, many of whom have returned to their villages. Getting migrant workers to resume work will need specific incentives such as reimbursing transportation costs and enhanced insurance protection, along with firm assurances of maintenance of hygiene protocols and provision of personal protective equipment at the construction sites.

OPPORTUNITIES AND CHALLENGES

The opportunities and challenges lie in the dichotomy of the current state of the housing sector in India. There are millions of Indian households with aspirations of becoming homeowners and are searching for homes that they can afford within their budget. Ironically, India is also faced with a large stock of housing comprising unsold completed units and under construction units which are in need of last mile funding.

The housing sector has benefitted from the government’s flagship housing programme, Pradhan Mantri Awas Yojana (PMAY). According to the Ministry of Housing and Urban Affairs, under the PMAY, over one crore homes have been sanctioned, of which 33.5 lac houses have been completed and 64 lac units are already under construction. The Credit Linked Subsidy Scheme (CLSS) -- a component under the PMAY has also enabled several households to become homeowners owing to the upfront subsidy given to eligible beneficiaries.

The government has been cognisant of several homebuyers who have not been able to get delivery of their homes due to delays by cashstrapped developers who are unable to complete construction of the housing units.

Towards this end, during the year, the government took the initiative to set up an alternative investment fund to provide last mile funding for incomplete affordable housing projects. The fund is called Special Window for Completion of Construction of Affordable and Mid- Income Housing Projects (SWAMIH Investment Fund).

The government estimated that this fund could help complete 4.58 lac housing units across 1,509 projects and most of these are concentrated in the top 8 cities in India. The fund restricts itself to middle and low budget homes. The projects have to be registered with the respective state real estate regulatory authority and must be net worth positive.

As the fund provides last mile funding, it comes in as a senior lender and existing creditors cede charge, becoming junior lenders.

SWAMIH Investment Fund is envisaged to create a ` 25,000 crore corpus, with the government committing up to ` 10,000 crore and the balance would be contributions from public sector banks, Life Insurance Corporation of India, amongst others investors. As the Corporation was involved and consulted in setting up this fund, it has also committed ` 250 crore. The objective of the Corporation’s investment was to support the sector and enable individuals to get possession of their homes. The fund announced its first fund close in December 2019 with an initial corpus of ` 10,530 crore.

In a bid to alleviate financial stress, certain developers have opted for joint development agreements and development management agreements. Stronger developers have taken over projects from weaker ones and some developers have opted for the last mile funding route. During the year, some lenders have opted to sell their loans to developers either to asset reconstruction companies or other institutions or opted for debt asset swaps. This facilitates quicker resolution of stressed loans.

INTEREST RATES & LIQUIDITY SCENARIO

During FY20, the repo rate which is determined by the Monetary Policy Committee (MPC) of the RBI was on a downward trajectory moving from 6% in April 2019 to 4.40% by March 2020. Up until February 2020, the changes were calibrated and smaller, while the change effected in March 2020, owing to the impact of COVID-19 was a sharp 75 basis points.

The initial cut by 25 basis points in April 2019 was against the backdrop of lower inflation and a recognition that output gap was negative and that the domestic economy was facing headwinds. The monetary policy stance, however, remained neutral.

In June 2019, the RBI reduced the repo by another 25 basis points and changed its monetary stance to accommodative. This was driven by a sharp slowdown in investment activity and moderation in private consumption growth. The MPC was of the view that an easing monetary policy would boost aggregate demand.

In August 2019, there were visible signs of a slowing domestic economy along with a deteriorating global growth outlook, largely triggered by escalating trade tensions. The RBI expressed that the standard 25 basis points cut would be inadequate while a 50 basis points reduction would be excessive and thus, in a departure from its standard practice, it opted for a 35 basis points repo rate reduction.

In October 2019, the RBI reduced the repo rate by a further 25 basis points to 5.15%. The RBI articulated despite several policy rate cuts, adequate monetary transmission was not happening within the system. The RBI thus mandated banks to link all new floating rate retail and MSME loans to an external benchmark. Most banks opted to use the repo rate as the external benchmark.

In February 2020, the RBI did not change the repo rate. The RBI stated that monetary transmission had improved and the weighted average lending rate of banks on fresh rupee loans sanctioned had reduced by 69 basis points over the period February 2019 to January 2020.

On March 27, 2020, as the COVID-19 induced crisis intensified leading to an extreme risk averse environment, the RBI in an unconventional policy move reduced the repo rate by 75 basis points to 4.40%.

During FY20, the system was mostly in surplus liquidity, though risk aversion in lending did not see this translating into enhanced credit growth. Year-on-year bank credit growth as at March 31, 2020 was 6%, hitting a five decade low.

During the year, the RBI used several unconventional tools to ensure sufficient liquidity. This included USD INR buy/sell swaps, operation twist – the simultaneous purchase of longterm securities and sale of short-term securities to reduce the steepness in the yield curve, long-term repo operations of tenors of one and three years and open market operations.

In the months of March and April 2020, the RBI introduced targeted long-term repo operations, reduced the cash reserve ratio by 100 basis points, increased the borrowing limits under the marginal standing facility, provided additional funds to refinance institutions and offered a special liquidity facility for mutual funds.

Despite large liquidity infusions by the RBI, in early May 2020, banks parked an estimated ` 8.5 trillion of excess liquidity with the central bank under the reverse repo facility. This indicated that banks were still risk averse, especially in lending to entities that were not high investment grade.

On further assessment of the impact of COVID-19 on the economy, the RBI on May 22, 2020, reduced the repo and reverse repo rate by 40 basis points each to stand at 4% and 3.35% respectively.

LOAN MORATORIUM

In accordance with the RBI guidelines relating to COVID-19 Regulatory Package dated March 27, 2020 and April 17, 2020, the RBI allowed commercial banks, co-operative banks, financial institutions and NBFCs to grant a 3-month moratorium on payment of instalments of all term loans which were standard assets as at February 29, 2020. The objective was to help alleviate the hardship of borrowers which was brought on by the national lockdown. The initial moratorium period was for payments between March 1, 2020 and May 31, 2020. On May 22, 2020, the RBI permitted an extension of the moratorium period by 3 months i.e. up to August 31, 2020.

Interest shall continue to accrue on the outstanding portion of the loan during the moratorium period. For all accounts where the moratorium is granted, the ageing of accounts shall remain stand still during the moratorium period.

Lenders were required to get board approval prior to offering their customers the moratorium. Lenders have adopted different methods in offering the moratorium -- either an ‘opt-in’ or ‘opt-out’ structure.

The Corporation has adopted an ‘optin’ structure for the moratorium. As of date, approximately 26% of the Corporation’s loans under management have opted for the moratorium. Of this, individual loans account for 21% of the individual loan portfolio.

IMPACT OF COVID-19

As is the case globally, in India, there continues to be a high degree of uncertainty on the duration of the lockdown, the possibility of second waves emerging, the effectiveness of measures taken to contain the spread of infection or mitigate its impact and the time horizon required for life, businesses and the overall economy to be restored to normalcy.

Accordingly, the extent to which the COVID-19 pandemic will impact the Corporation’s business and financial results will necessarily depend on future developments, which entail a high degree of uncertainty.

FINANCIAL AND OPERATIONAL PERFORMANCE

Financial Performance

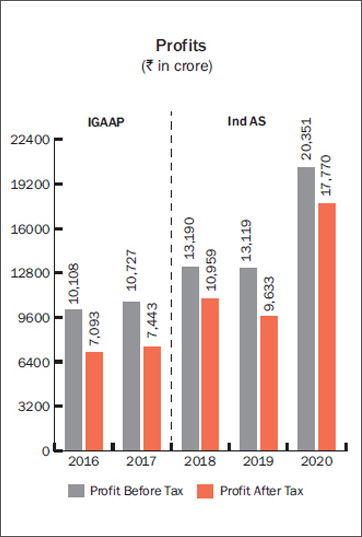

The total income for the year ended March 31, 2020 stood at ` 58,763 crore compared to ` 43,378 crore in the previous year, representing a growth of 35%. Total expenses stood at ` 38,412 crore compared to ` 30,259 crore in the previous year, representing a growth of 27%.

The reported profit before tax for the year ended March 31, 2020 stood at ` 20,351 crore compared to ` 13,119 crore in the previous year.

After providing for tax of ` 2,581 crore (previous year: ` 3,486 crore), the profit after tax before other comprehensive income for the year ended March 31, 2020 stood at ` 17,770 crore compared to ` 9,633 crore in the previous year.

The reported profits for the year are not comparable with those of the previous year.

To facilitate a like-for-like comparison, after adjusting for the fair value on gain consequent to the scheme of amalgamation, other fair value changes, profit on sale of investment, dividend and provisioning, the adjusted profit before tax for the year ended March 31, 2020 is ` 12,541 crore compared to ` 11,159 crore in the previous year, reflecting a growth of 12%.

During the year, the fair value gain on the scheme of amalgamation stood at ` 9,020 crore (PY: nil). This was on account of the merger of GRUH Finance Limited (GRUH) and Bandhan Bank Limited (Bandhan), details of which are given below.

In January 2019, the board of directors of GRUH and Bandhan approved a scheme of amalgamation for the merger of GRUH into and with Bandhan. The share exchange ratio was 568 equity shares of face value ` 10 each of Bandhan for every 1,000 fully paid-up equity shares of face value ` 2 each of GRUH.

As at April 1, 2019 i.e. the beginning of the financial year under review, HDFC held 56.1% of the share capital of GRUH and thus, the company was a subsidiary of the Corporation.

In April 2019, the RBI granted its approval to the Corporation to acquire and hold up to 9.90% of the paid-up voting equity capital of Bandhan, upon the effective date of the scheme.

Between May and August 2019, the Corporation sold 13,09,86,774 equity shares of GRUH in the open market so as to ensure that the Corporation would be entitled to only 9.90% of the post-merger paid-up share capital of Bandhan, considering the share exchange ratio. The profit on sale of investments on account of this stood at ` 3,524 crore.

With effect from October 17,

2019, GRUH merged into and with

Bandhan. The Corporation was allotted

15,93,63,149 shares aggregating

9.90% of the total issued share

capital of Bandhan. Accordingly, on

derecognition of the investment in

GRUH, the Corporation has recorded

a fair value gain of

` 9,020 crore on

the investment in GRUH.

The total comprehensive income for the year ended March 31, 2020 stood at ` 11,117 crore compared to ` 9,501 crore in the previous year.

Statement of Profit and Loss

Key elements of the statement of profit and loss for the year ended March 31, 2020 are:

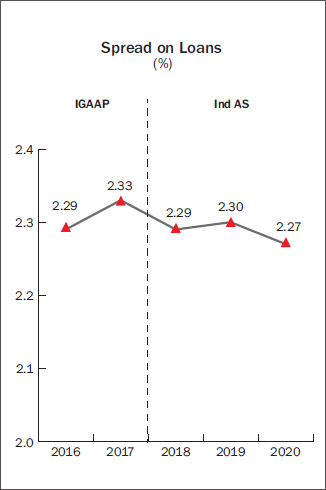

Spread on Loans

The average yield on loan assets during the year was 10.18% per annum compared to 10.29% in the previous year. The average all-inclusive cost of funds was 7.91% per annum as compared to 7.99% in the previous year. The spread on loans over the cost of borrowings for the year was 2.27% per annum as against 2.30% in the previous year. Spread on individual loans for the year was 1.92% and on non-individual loans was 3.14%.

Operational Performance

Lending Operations

During the year, the demand for affordable home loans continued to be strong. The government continued its support and thrust towards affordable housing through continued fiscal incentives for home loan borrowers. For under construction residential projects, the Goods and Services Tax (GST), with input tax credit was earlier 12% and 8% for affordable homes. In a bid to encourage more housing, during the year, the GST rates for under construction housing projects was reduced to 5% and 1% for affordable homes, without input tax credit.

Individual loan approvals grew by 14% in number terms and 12% in value terms during the year. The average size of individual loans stood at ` 27 lac during the year, the same as the previous year. Based on loans disbursed during the year, 82% were salaried customers, while 18% were self-employed (including professionals). In terms of the acquisition mode, of the loans disbursed during the year, 53% were first-purchase homes i.e. directly from the builder, 9% selfconstruction and 38% were through resale.

In order to better price its loans, factoring in risks, credit scores and customer profiles, during the year, the Corporation segregated its benchmark lending rate for housing and non-housing retail housing loans.

The Corporation remained steadfast in its commitment towards supporting the government’s flagship scheme, ‘Housing for All’ and continued to pursue efforts towards lending to the Economically Weaker Section (EWS), Low Income Group (LIG) and Middle Income Group (MIG) segments.

The Corporation has the largest number of home loan customers – of approximately 1.73 lac who have availed benefits under the Credit Linked Subsidy Scheme (CLSS). As at March 31, 2020, cumulative loans disbursed by the Corporation under CLSS stood at ` 29,026 crore and the cumulative subsidy amount stood at ` 3,855 crore.

The Corporation continued its focus on lending to credit worthy home loan customers across all income segments as given below:

Housing Loan Approvals to Customers Based on Income Slabs in FY20

| Category | Household Income per annum | Home Loan Approvals in

FY20 |

|

|---|---|---|---|

| % in Value Terms | % in Number Terms | ||

| Economically Weaker Section | Up to ` 3 lac | 2% | 6% |

| Low Income Group | Above ` 3 lac up to ` 6 lac | 16% | 30% |

| Middle Income Group | Above ` 6 lac up to ` 18 lac | 46% | 47% |

| High Income Group | Above ` 18 lac | 36% | 17% |

| Total | 100% | 100% | |

On an average, the Corporation has been approving approximately 9,600 loans on a monthly basis to the EWS and LIG segment, with monthly such average approvals at ` 1,589 crore. The average home loan to the EWS and LIG segment during the year stood at ` 10.3 lac and ` 17.7 lac respectively.

The Corporation’s niche products such as ‘HDFC Reach’ which addresses the housing needs of the informal sector and micro entrepreneurs and ‘HDFC Rural Loans’ which largely focuses on customers with rural incomes or acquiring homes in rural and peripheral rural areas continued to gain traction during the year.

As at March 31, 2020, cumulatively, the Corporation had financed 7.7 million housing units.

As far as non-individual loans are concerned, the Corporation opted to be cautious in lending, given the increased risk averseness that set in during the year under review. Many developers remained under stress due to high leverage and tight cashflows, besides slow sales and high unsold inventories.

A large segment of the corporate sector too, continued to face challenges of excess leverage and revival of the investment cycle did not gain traction.

During the year, the Corporation focused on lending to select, top grade corporates and lease rental discounting. Given the increased stress amongst developers, loans for construction finance were given to select developers.

Loan Portfolio

The loan approval process of the Corporation is decentralised, with varying approval limits. The Corporation has a three-tiered committee of management structure with varying approval limits. Larger proposals, as appropriate, are referred to the Board of Directors.

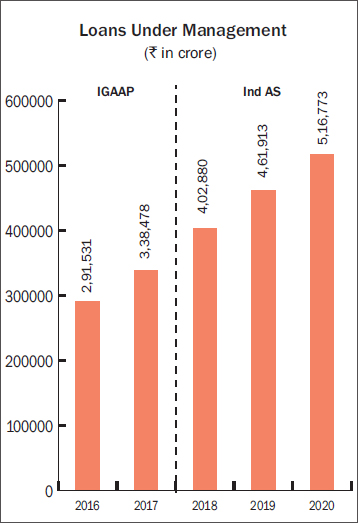

The Assets Under Management (AUM) as at March 31, 2020 amounted to ` 5,16,773 crore as compared to ` 4,61,913 crore in the previous year.

On an AUM basis, the growth in the individual loan book was 14% and the non-individual loan book was 6%. The growth in the total loan book on an AUM basis was 12%.

During the year, the Corporation’s loan book increased from ` 4,06,607 crore to ` 4,50,903 crore as at March 31, 2020. In addition, total loans securitised and/or assigned by the Corporation and outstanding as at March 31, 2020 amounted to ` 65,870 crore.

The lower growth in the loan book was due to the continued unfavourable lending environment for nonindividual loans that prevailed during the financial year under review. Risk averseness in lending, high leverage and credit rating downgrades led to increased corporate stress and heightened risks, particularly in the construction finance. In order to preserve asset quality, the Corporation opted to be prudent by curtailing some of its lending to nonindividual loans.

The table below provides a synopsis of the gross loan book of the Corporation:

(` Crore)

| As at March 31, 2020 |

As at March 31, 2019 |

|

|---|---|---|

| Individual Loans | 3,25,923 | 2,88,819 |

| Corporate Bodies | 1,18,165 | 1,10,915 |

| Others | 6,815 | 6,873 |

| Total | 4,50,903 | 4,06,607 |

The net increase in the loan book during the year, (after removing the loans that were sold) stood at ` 44,296 crore.

Principal loan repayments stood at ` 90,223 crore compared to ` 1,03,914 crore in the previous year after excluding loans written off during the year amounting to ` 995 crore (Previous Year: ` 657 crore).

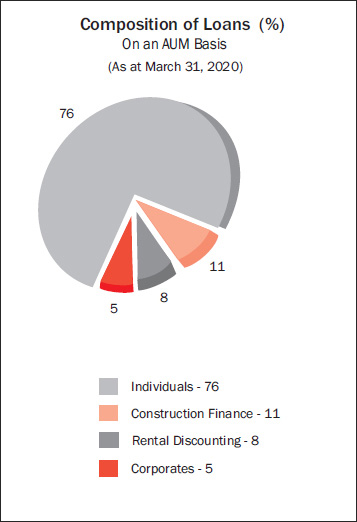

Prepayments on retail loans stood at 10.9% of the opening balance of individual loans compared to 10.7% in the previous year. 61% of these prepayments were full prepayments. Of the total loan book (including loans sold), individual loans comprise 76%.

The growth in the individual loan book, after adding back loans sold in the preceding twelve months was 21% (13% net of loans sold).

Non-individual loans grew by 6% during the year and comprised 24% of the portfolio.

The growth in the total loan book would have been 17% had the Corporation not sold any loans during the year.

The growth in housing loans in the banking sector during the year also entailed substantial buy-outs of home loan portfolios from other housing finance companies and NBFCs. In comparison, the entire growth in the Corporation’s loan portfolio was organic.

Assignment/Sale of Loans

During the year, the Corporation, sold individual loans amounting to ` 24,127 crore (Previous Year: ` 25,150 crore). All the loans assigned during the year were to HDFC Bank pursuant to the buyback option embedded in the home loan arrangement between the Corporation and HDFC Bank. Of the total loans sold during the year, ` 4,947 crore qualified as priority sector advances for banks.

As at March 31, 2020, individual loans outstanding in respect of all loans assigned/securitised stood at ` 65,695 crore. HDFC continues to service these loans.

The advantage for the Corporation in selling loans under the loan assignment route is that there is no credit enhancement to be provided by the Corporation on the loans sold and the risk is passed on to the purchaser. The assignment of loans is also Return on Equity accretive to the Corporation as no capital or provisioning is required to be maintained on these loans.

Product-wise Loan Performance

As at March 31, 2020, the productwise break-up of loans on an AUM basis was -- individual loans: 76%, corporate loans: 5%, construction finance: 11% and commercial lease rental discounting: 8%.

During the year, on an AUM basis, 89% of the incremental growth in the loan book came from individual loans.

Sourcing of Loans

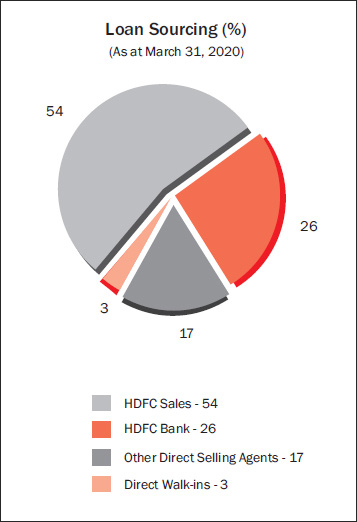

The Corporation’s distribution channels which include HDFC Sales Private Limited (HSPL), HDFC Bank and third party direct selling associates (DSAs) play an important role in sourcing home loans.

HDFC has third-party distribution tieups with commercial banks, small finance banks, non-banking financial companies and other distribution companies including e-portals for retail loans. All distribution channels only source loans, while the control over the credit, legal and technical appraisal continues to rest with HDFC, thereby ensuring that the quality of loans disbursed is not compromised in any way and is consistent across all distribution channels.

In value terms, HSPL, HDFC Bank and third party DSAs sourced 54%, 26% and 17% of home loans disbursed respectively during the year. Thus, total loans sourced from distribution channels accounted for 97% of individual loans disbursed by HDFC in value terms. 83% of the Corporation’s individual loan business during the year was sourced directly or through the Corporation’s affiliates.

Marketing, Distribution and Digital Initiatives

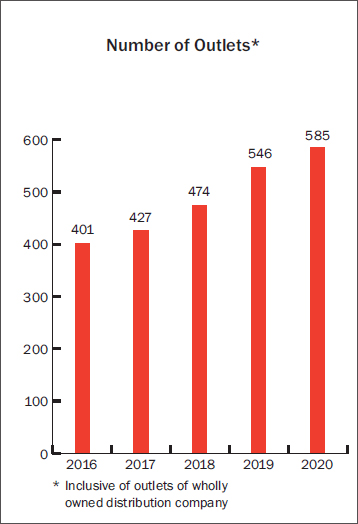

During the year, ef for ts were concentrated on further strengthening the distribution network through a combination of increased physical offices and digital initiatives. The Corporation’s physical distribution network now spans 585 outlets, which includes 206 offices of HDFC’s wholly owned distribution company, HSPL.

HDFC has overseas offices in London, Singapore and Dubai. The Dubai office caters to customers across Middle-East through its service associates.

Leveraging its long-standing relationships with leading developers from across the country, HDFC organised property exhibitions in India and overseas as a value-added service for home seekers, enabling them to choose from a wide choice of property options. Supplementing this effort was the Corporation’s online interactive platform showcasing a wide range of real estate projects from reputed developers across India for HDFC’s ‘India Homes Fair’ held overseas.

To enhance the digital experience, HDFC integrated Natural Language Processing (NLP) and Machine Learning (ML) technology with its website chatbot to understand and analyse user intent, effectively respond to user interaction and thereby deliver an enhanced customer experience.

HDFC executed several digital brand campaigns during the year, including Google’s DoubleClick marketing platform. This resulted in over 150 crore brand impressions on various online platforms.

To ensure faster load times on the mobile, HDFC launched Accelerated Mobile Pages on its website. The improved page speed and better user experience led to higher search engine optimisation (SEO) rankings for the brand.

A user can now get consumer information on the Corporation’s website in six Indian languages - Hindi, Marathi, Tamil, Telugu, Malayalam and Kannada. This is particularly helpful to better serve the growing base of Indian language users on the internet, particularly in tier II, tier III cities and rural areas. HDFC also integrated Language Localisation Technology (LLT) to execute digital brand and marketing campaigns in regional languages, leading to a better connect with the target audience.

During the year, HDFC strengthened its team of dedicated data analytics professionals who focus on extracting useful customer insights through various data models, thereby helping to increase business.

Investments

The Investment Committee constituted by the Board of Directors is responsible for approving investment proposals in line with the limits as set out by the Board of Directors.

The investment function supports the core business of housing finance. The investment mandate includes ensuring adequate levels of liquidity to support core business requirements, maintaining a high degree of safety and optimising the level of returns, consistent with acceptable levels of risk.

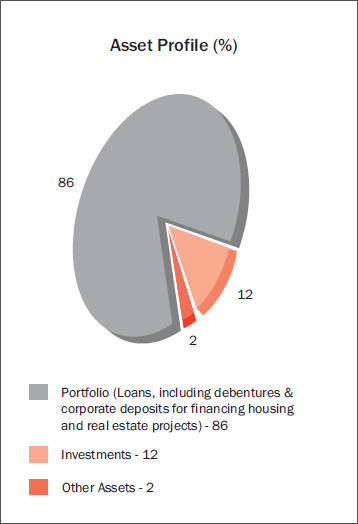

As at March 31, 2020, the investment portfolio stood at ` 64,944 crore compared to ` 46,240 crore in the previous year. The proportion of investments to total assets was 12%. The increase in the investment portfolio during the year was primarily on account of the larger amounts invested in high quality liquid assets.

The Corporation maintained substantially higher liquidity buffers, owing to increased uncertainties and risk averseness in the financial sector. Accordingly, the average balances maintained in liquid mutual funds was significantly higher compared to the previous year.

Housing finance companies are required to maintain a statutory liquidity ratio (SLR) in respect of public deposits raised. As at March 31, 2020, the SLR requirement was 13% of public deposits. As at March 31, 2020, the Corporation had ` 14,268 crore invested in government securities.

As at March 31, 2020, the treasury portfolio (excluding investments in equity shares and equity linked products) had an average balance period to maturity of 33.4 months. The average yield on the non-equity treasury portfolio for the year was 6.8% per annum on an annualised basis.

Surplus from deployment of liquid funds in Cash Management Schemes of Mutual Funds was ` 1,102 crore.

Dividend received during the year was ` 1,081 crore, of which ` 1,069 crore was received from subsidiary and associate companies.

In March 2020, the Corporation along with seven other Indian private and public sector commercial banks infused equity capital in RBI’s ‘Yes Bank Reconstruction Scheme’. This was a collective effort of the government, RBI and investors to infuse capital in Yes Bank with the broader objective of retaining financial system stability. The Corporation invested in 100 crore equity shares of face value of ` 2 each for a consideration of ` 10 per share (premium of ` 8 per share), aggregating ` 1,000 crore. As per the scheme, 25% of the Corporation’s equity shares are free, while 75% are locked-in for a period of 3 years.

The equity investments in Bandhan Bank and Yes Bank are classified as Fair Value Through Other Comprehensive Income.

As at March 31, 2020, the market value of listed equity investments in subsidiary and associate companies was higher by ` 1,54,461 crore compared to the value at which these investments are reflected in the balance sheet. This unaccounted gain includes appreciation in the market value of investments in HDFC Bank held by HDFC’s wholly owned subsidiaries, HDFC Investments Limited and HDFC Holdings Limited. It, however, excludes the unrealised gains on unlisted subsidiaries such as HDFC ERGO General Insurance Company Limited, HDFC Credila Financial Services Private Limited, amongst others.

Asset Quality

Given the increased financial stress in the system, the Corporation continued to lay great emphasis on asset quality and ensured that there is adequate provisioning for unforeseen contingencies.

outstanding in respect of individual loans where the instalments were in arrears constituted 0.95% of the individual portfolio and the corresponding figure was 4.71% in respect of the non-individual portfolio.

As per the prudential norms prescribed by NHB, the Corporation is required to carry a provision of ` 4,198 crore, of which ` 2,267 crore is on account of non-performing assets and the balance is in respect of standard loans. The actual provisions carried stood at ` 10,988 crore.

On a gross basis, the Corporation has written off loans aggregating to ` 995 crore during the year. On loans that have been written off, the Corporation will continue making efforts to recover the money. The Corporation has, since inception, written off loans (net of subsequent recovery) aggregating to ` 2,001 crore. Thus, as at March 31, 2020, the total loan write offs stood at 14 basis points of cumulative disbursements since inception of the Corporation.

In accordance with the write off policy of the Corporation, loans may entail either a partial or a full write off, determined on a case-by-case basis.

During the year, where recovery has proven to be difficult, the Corporation has adopted various methods to settle loans. In certain instances, the Corporation has initiated insolvency proceedings. The Corporation has also opted to reach settlements through sell-downs to asset reconstruction companies, institutions or private equity players. In certain overdue loans, the Corporation has resorted to the invocation of pledged shares.

In addition, given the increased stress faced by developers, the Corporation has in select cases, entered into debt asset swap (DAS) arrangements entailing immovable property. Whilst entering into such arrangements, the Corporation’s key considerations are the marketability and saleability of the property, its present and expected valuation, demand and supply factors based on the location of the property, legal titles, whether it is free from encumbrances, amongst other factors. The properties taken over by the Corporation are a mix of residential and commercial properties located in key metro cities. The properties are either for the Corporation’s own use or being held for capital appreciation, which the Corporation will dispose of at an appropriate time and in accordance with directions as stipulated by NHB.

Accordingly, during the year, the Corporation has entered into debt asset swaps wherein the gross carrying amount of the financial and non-financial assets taken over as at March 31, 2020 stood at ` 62 crore and ` 848 crore respectively.

Impairment on Financial Instruments - Expected Credit Loss

Under Ind AS, asset classification and provisioning moves from the ‘rule based’, incurred loss model to the Expected Credit Loss (ECL) model of providing for expected future credit losses. Thus, loan loss provisions are made on the basis of the Corporation’s historical loss experience and future expected credit loss, after factoring in various other parameters.

Classification of Assets

(%)

| Exposure at Default (EAD) | As at March 31, 2020 |

As at March 31, 2019 |

|---|---|---|

| Stage 1 | 92.2% | 94.3% |

| Stage 2 | 5.5% | 4.3% |

| Stage 3 | 2.3% | 1.4% |

| Total | 100.00 | 100.00 |

Expected Credit Loss Based on Exposure at Default (EAD)

(` crore)

| Particulars | As at March 31, 2020 |

As at March 31, 2019 |

|---|---|---|

| Gross Stage 1 | 4,15,864 | 3,84,272 |

| ECL Provision Stage 1 | 346 | 242 |

| Net Stage 1 | 4,15,518 | 3,84,030 |

| Coverage Ratio% Stage 1 | 0.08% | 0.06% |

| Gross Stage 2 | 24,794 | 17,638 |

| ECL Provision Stage 2 | 5,750 | 3,135 |

| Net Stage 2 | 19,044 | 14,503 |

| Coverage Ratio% Stage 2 | 23% | 18% |

| Gross Stage 3 | 10,273 | 5,737 |

| ECL Provision Stage 3 | 4,892 | 2,501 |

| Coverage Ratio% Stage 3 | 47% | 43% |

| EAD | 4,50,931 | 4,07,647 |

| ECL Provision | 10,988 | 5,878 |

| Net | 4,39,943 | 4,01,769 |

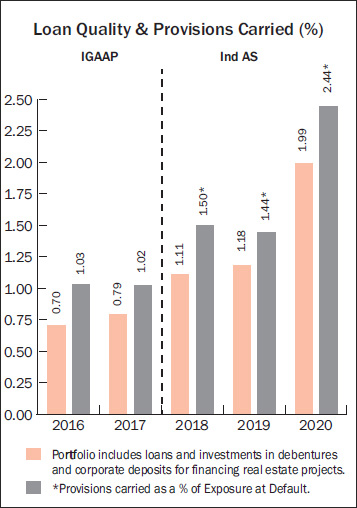

| ECL/EAD | 2.44% | 1.44% |

The total balance in the Impairment on Financial Instruments – Expected Credit Loss (provisions carried) as at March 31, 2020 amounted to ` 10,988 crore. This is equivalent to 2.44% of the EAD. The balance in the Impairment on Financial Instruments – Expected Credit Loss more than adequately covers loans where the instalments were in arrears for over 90 days.

Fixed Assets and Investment Properties

Net fixed assets as at March 31, 2020 amounted to ` 1,349 crore. Net additions to fixed assets during the year was ` 824 crore, including right-of-use assets of ` 268 crore.

Net investment in properties as at March 31, 2020 amounted to ` 890 crore. Net additions to investment properties during the year was ` 313 crore.

Resource Mobilisation

Share Capital

As on April 1, 2019, the Corporation had a balance of ` 344 crore in the share capital account. The Corporation has allotted 1,06,13,799 equity shares of ` 2 each pursuant to exercise of stock options by certain employees/directors. After considering the above allotment during the year, the balance in the share capital account as on March 31, 2020 is ` 346 crore.

Subordinated Debt

As at March 31, 2020, the Corporation’s outstanding subordinated debt stood at ` 5,000 crore. The debt is subordinated to present and future senior indebtedness of the Corporation and has been assigned the highest rating of ‘CRISIL AAA/Stable’ and ‘ICRA AAA/Stable’. The Corporation did not issue any subordinated debt during the year.

Based on the balance term to maturity, as at March 31, 2020, ` 2,600 crore of the book value of subordinated debt was considered as Tier II under the guidelines issued by the National Housing Bank (NHB) for the purpose of capital adequacy computation.

Borrowings

During the year, NHB amended its directions as follows:

| Timeline | Ratio of

Borrowing to

Net Own Funds |

|---|---|

| On or after March 31, 2020* | 14 times |

| On or after March 31, 2021 | 13 times |

| On or after March 31, 2022 | 12 times |

*Previously the ratio of borrowings to net owned funds was 16 times.

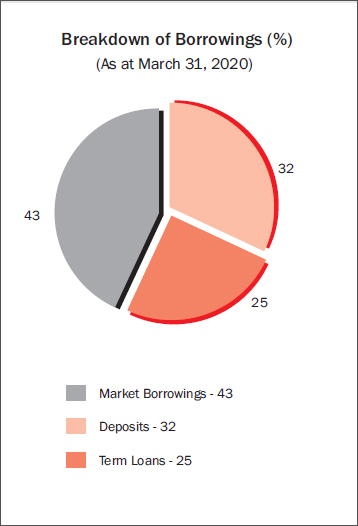

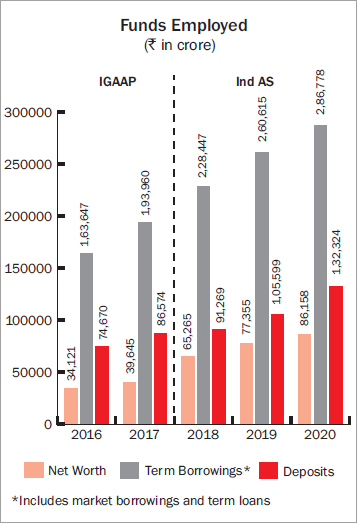

Borrowings as at March 31, 2020 amounted to ` 4,19,102 crore as against ` 3,66,214 crore in the previous year - an increase of 14%. Borrowings constituted 80% of funds employed as at March 31, 2020. Of the total borrowings, debentures and securities constituted 43%, deposits 32% and term loans 25%.

Summary of Total Borrowings

(` crore)

| Borrowings | March 31,

2020 |

March 31,

2019 |

|---|---|---|

| Term Loans | 1,04,909 | 77,548 |

| Market Borrowings | 1,81,869 | 1,83,067 |

| Deposits | 1,32,324 | 1,05,599 |

| Total | 4,19,102 | 3,66,214 |

Non-Convertible Debentures & Commercial Paper

During the year under review, the Corporation raised an amount of ` 46,437 crore through secured redeemable non-conver t i b l e debentures (NCDs), issued in various tranches on a private placement basis. The Corporation’s NCD issues have been listed on the wholesale debt market segment of the NSE and the BSE. The NCD issues have been assigned the highest rating of ‘CRISIL AAA/Stable’ and ‘ICRA AAA/Stable’. The Corporation has been regular in making payments of principal and interest on the NCDs.

There are no NCDs which have not been claimed by investors or not paid by the Corporation after the date on which the NCDs became due for redemption.

The Corporation has been qualified as a ‘large corporate’ by the Securities and Exchange Board of India and accordingly has ensured that more than 25% of its incremental borrowings during the year was by way of issuance of debt securities.

The Corporation’s short-term debt programme has been assigned the highest ratings of ‘CRISIL A1+’, ‘ICRA A1+’ and ‘CARE A1+’ by CRISIL, ICRA and CARE Ratings respectively.

As at March 31, 2020, the Corporation had commercial paper (CPs) with an outstanding amount of ` 28,715 crore and the weighted average outstanding maturity was 325 days. CPs constituted 7% of the outstanding borrowing as at March 31, 2020. The CPs of the Corporation are listed on the wholesale debt market segment of the NSE and the BSE.

Rupee Denominated Bonds Overseas

Under the Corporation’s Medium Term Note Programme, the Corporation did not raise any funds through Rupee denominated bonds during the year. As at March 31, 2020, total outstanding Rupee denominated bonds overseas stood at ` 6,100 crore.

Deposits

During the year, NHB amended its directions wherein housing finance companies can accept public deposits not exceeding 3 times its net owned funds as against 5 times earlier.

As at March 31, 2020, total

outstanding deposits stood at

` 1,32,324 crore compared to

` 1,05,599 crore in the previous

year. The number of deposit accounts

stood at over 21 lac.

CRISIL and ICRA have for the twentyfifth consecutive year, reaffirmed their ‘CRISIL FAAA/Stable’ and ‘ICRA MAAA/Stable’ ratings respectively for HDFC’s deposits. These ratings represent the highest degree of safety regarding timely servicing of financial obligations and also carries the lowest credit risk.

Increasing uncertainties in market conditions led to a flight to safety, which was reflected in the strong mobilisation of deposits of the Corporation during the financial year. The renewal ratio of individual deposits stood at 69% during the year.

The Corporation has over 24,000 active key deposit agents. Brokerage is paid on the deposits generated by deposits agents, depending on the product, amount and period of the deposit. Incentive is also paid on certain products, depending on the amount of deposits generated by the deposit agent. Brokerage and incentive payments are amortised over the period of the deposit.

The Corporation’s deposit online platform, https://online.hdfc.com/hdfcdeposits/ has been well received and is simple and convenient to use, besides being a green initiative.

Term Loans from Banks, Institutions and Refinance from NHB

As at March 31, 2020, the total loans outstanding from banks, institutions and NHB (including foreign currency borrowings from domestic banks) amounted to ` 1,04,909 crore as compared to ` 77,548 crore as at March 31, 2019.

HDFC’s long-term and short-term bank loan facilities have been assigned the highest rating by CARE and ICRA, signifying highest safety for timely servicing of debt obligations.

During the year, the Corporation availed refinance from NHB under various refinance schemes such as Affordable Housing Fund, Regular Refinance Scheme and Liquidity Infusion Facility Scheme amounting to ` 7,800 crore.

External Commercial Borrowings

The Corporation has in place a medium term note programme for an amount of up to US$ 2.8 billion which enables the Corporation to issue rupee/foreign currency denominated bonds in the international capital markets, subject to regulatory approvals.

In May 2019 the Corporation raised an ECB of US$ 200 million in the form of a syndicated loan facility. The ECB was for a tenor of 3 years. The ECB was raised under the Low Cost Affordable Housing Scheme of the RBI. The proceeds are being utilised for financing prospective owners/ developers of low cost affordable housing units.

The outstanding external commercial borrowings constitute borrowings from Asian Development Bank under the Housing Finance Facility Project (US$ 20 million) and External Commercial Borrowing (ECB) under RBI’s Low Cost Affordable Housing Scheme (US$ 2,314 million).

Financial Risk Management

The Corporation manages its interest rate and currency risk in accordance with its Financial Risk Management and Asset Management Policy and guidelines prescribed. The risk management strategy has been to protect against foreign exchange risk, whilst at the same time exploring any opportunities for an upside, so as to keep the maximum all-in cost on the borrowing in line with or lower than the cost of a borrowing in the domestic market for a similar maturity.

The Corporation has to manage various risks associated with the lending business. These risks include credit risk, liquidity risk, foreign exchange risk and interest rate risk. HDFC manages credit risk through stringent credit norms. Liquidity risk and interest rate risks arising out of maturity mismatch of assets and liabilities are managed through regular monitoring of the maturity profiles.

The Corporation has from time to time entered into risk management arrangements in order to hedge its exposure to foreign exchange and interest rate risks. The currency risk on the borrowings is actively hedged through a combination of dollar denominated assets, long term forward contracts and principal only swaps.

As at March 31, 2020, the Corporation had foreign currency borrowings of US$ 4,916 million equivalent and had risk management arrangements such as principal only swaps and forward/ option contracts of the identical amount. Thus, as at March 31, 2020, there was no open foreign currency position.

As a part of asset liability management on account of the increasing response to HDFC’s Adjustable Rate Home Loan product as well as to reduce the overall cost of funding, the Corporation has entered into interest rate swaps and coupon only swaps. As at March 31, 2020, the Corporation has entered into such swaps whereby it has converted its fixed rate rupee liabilities on NCDs/ term loans of a notional amount of ` 61,500 crore for varying maturities into floating rate liabilities linked to MIBOR and the yield on government securities. As a result of the swaps, the Corporation pays the floating rate and receives the fixed rate.

The Corporation does not have any exposures to commodities and hence does not have any commodity price risk.

Asset-Liability Management (ALM)

Assets and liabilities are classified on the basis of their contracted maturities. However, the estimates based on past trends in respect of prepayment of loans and renewal of liabilities which are in accordance with the ALM guidelines issued by NHB have not been taken into consideration while classifying the assets and liabilities under the Schedule III.

The ALM position of the Corporation is based on the maturity buckets as per the guidelines issued by NHB. In computing the information, certain estimates, assumptions and adjustments have been made by the management. The ALM position is as under:

As at March 31, 2020, assets and liabilities with maturity up to 1 year amounted to ` 1,19,436 crore and ` 1,17,916 crore respectively. Assets and liabilities with maturity of greater than 1 year and up to 5 years amounted to ` 2,38,899 crore and ` 2,30,150 crore respectively and assets and liabilities with maturity beyond 5 years amounted to ` 1,76,718 crore and ` 1,86,987 crore respectively.

The Corporation’s loan book is predominantly floating rates, whereas liabilities especially deposits and non-convertible debentures are fixed rates. Some of the fixed rate liabilities are converted into floating rate denominated liabilities by way of interest rate swaps. The Corporation monitors the money market conditions closely and enters into interest rate swaps at appropriate times to minimise the interest rate gap. As at March 31, 2020, 85% of the total assets and 75% of the total liabilities were on a floating rate basis.

Capital Adequacy Ratio

During the year, NHB made amendments as follows:

| Timeline | Minimum Capital Adequacy Ratio | Minimum Tier 1 Capital |

|---|---|---|

| On or before March 31, 2020* | 13% | 10% |

| On or before March 31, 2021 | 14% | |

| On or before March 31, 2022 | 15% |

*Previously the minimum capital adequacy ratio was 12% and Tier I capital was 6%

The Corporation’s capital adequacy ratio (CAR) stood at 17.6%, of which Tier I capital was 16.5% and Tier II capital was 1.1%. The investment in HDFC Bank has been considered as a deduction in the computation of Tier I capital.

As at March 31, 2020, the risk weighted assets stood at around ` 3,93,000 crore.

Internal Control Systems and their Adequacy

HDFC has instituted adequate internal control systems commensurate with the nature of its business and the size of its operations. Internal audit is carried out by independent firms of chartered accountants and cover all the offices and key areas of business. All significant audit observations and follow-up actions thereon are reported to the Audit & Governance Committee. All the members of the Audit & Governance Committee are independent directors.

Material Developments in Human Resources

Human resources are HDFC’s most valuable assets. The Corporation is focused on continuously training and upgrading the work skills of its staff across the organisation. During the year, new recruits participated in an induction programme at the Centre for Housing Finance, which is the Corporation’s training centre in Lonavla. Other inhouse programmes were in the areas of leadership, mentoring, train the trainer, negotiative skills and other operational related areas. A new customer centric training workshop, “ZEST to Serve” was introduced during the year with the objective of sharing best practices on customer service.

The Corporation has its own online learning management system called ‘HDFC Aspire’, which is an e-learning tool which enables employees to selflearn and upgrade their skills. Special e-learning modules launched and assigned during the year were in the areas of rural housing finance, know your customer, credit and technical appraisals, lending products, business development, cyber security, prevention of sexual harassment of women at the workplace, soft skills, amongst others. Based on the assessments, the e-learning modules have been well received by the staff.

As at March 31, 2020, the Corporation has 379 offices (excluding offices of HSPL) and the total number of employees is 3,095.

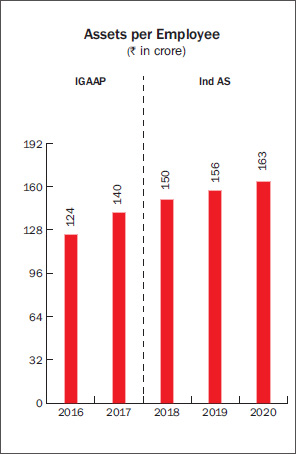

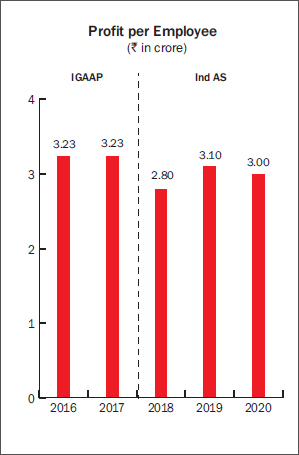

Total assets per employee as at March 31, 2020 stood at ` 163 crore as compared to ` 156 crore in the previous year. The net profit per employee (after adjusting for sale of strategic investments) as at March 31, 2020 was ` 3.0 crore compared to ` 3.1 crore in the previous year.

International Housing Finance Initiatives

HDFC’s expertise in housing finance is well regarded and therefore a number of existing and new housing finance companies are keen to tap the Corporation for training and technical assistance in housing finance.

The Corporation conducted its own international programme, ‘Housing Finance Management’ at its training centre, Centre for Housing Finance. Participants from countries across Asia and Africa attended the weeklong residential training programme. The Corporation also organised a residential training programme on mortgage finance for a delegation from a Vietnamese bank.

The Frankfurt School of Finance & Management and HDFC jointly organised the twelfth ‘Housing Finance Summer Academy’ in Germany. The course aims to provide housing finance solutions for emerging markets through a combination of academic knowledge and practical experience.

During the year, the Corporation undertook consultancy assignments in Bangladesh and Indonesia. Senior executives from housing finance companies in Bangladesh and Mauritius visited HDFC to understand housing finance operations.

Awards and Recognitions

During the year, some of the awards and recognitions received by the Corporation included:

Subsidiaries and Associates

Though housing finance remains the core business, the Corporation has continued to make investments in its subsidiary and associate companies. These investments are made in companies where there are strong synergies with the Corporation. The Corporation will continue to explore avenues for such investments with the objective of providing a wide range of financial services and products under the HDFC brand name.

The Corporation made gross investments in the equity share capital of its associate and subsidiary companies – HDFC ERGO Health Insurance Limited (` 1,496 crore), HDFC Credila Financial Services Private Limited (` 636 crore), Good Host Spaces Private Limited (` 87 crore), HDFC Education and Development Services Private Limited (` 20 crore), and HDFC ERGO General Insurance Company Limited (` 5 crore).

During the year, compulsorily convertible preference shares of HDFC Credila Financial Services Private Limited (HDFC Credila) were converted into equity shares. Further, in December 2019, the Corporation acquired 1,14,70,000 equity shares of face value of ` 10 each representing 9.12% of the equity share capital on a fully diluted basis of HDFC Credila from the other promoters of the company. Pursuant to the acquisition, HDFC Credila became a wholly-owned subsidiary of the Corporation.

Given the low penetration of health insurance in India, the Corporation believes that there is tremendous scope for growth in this sector. Accordingly, during the year, the Corporation acquired 20,75,15,521 equity shares of HDFC ERGO Health Insurance Limited (HDFC ERGO Health), formerly Apollo Munich Health Insurance Company Limited, representing 51.16% of its equity share capital. Consequently, HDFC ERGO Health became a subsidiary of the Corporation. HDFC ERGO Health is licensed as a general insurer and specialises in health insurance in India.

On January 9, 2020, the Board of Directors of HDFC ERGO Health and HDFC ERGO General Insurance Company Limited (HDFC ERGO) approved the Scheme of Arrangement and Amalgamation for the merger of HDFC ERGO Health with and into HDFC ERGO. As per the scheme, the approved share exchange ratio is 100 equity shares of face value of ` 10 each of HDFC ERGO for every 385 equity shares of face value of ` 10 each of HDFC ERGO Health. The application for the proposed merger has been filed by HDFC ERGO Health and HDFC ERGO with the National Company Law Tribunal, Mumbai.

In May 2020, the RBI directed the Corporation to reduce its shareholding in its insurance companies to 50% or below.

Based on the shareholding of the Corporation in HDFC ERGO and taking into consideration the share exchange ratio (for the merger of HDFC ERGO with HDFC ERGO Health), the Corporation is entitled to 50.6% stake in the merged entity (i.e. HDFC ERGO). RBI has directed the Corporation to bring down its shareholding in the merged entity to 50% or below within a period of 6 months from the effective date of the merger.

RBI has also directed the Corporation to bring down its shareholding in HDFC Life Insurance Company Limited (HDFC Life) to 50% or below on or before December 16, 2020. The Corporation holds 51.4% of the paid-up share capital of HDFC Life as on the date of this report.

The financials with respect to HDFC Bank Limited, HDFC Life Insurance Company Limited, HDFC ERGO General Insurance Company Limited and HDFC ERGO Health Insurance Limited are presented as per their statutory financial statements prepared under Indian GAAP.

Review of Key Subsidiary and Associate Companies

HDFC Bank Limited (HDFC Bank)

HDFC and HDFC Bank continue to maintain an arm’s length relationship in accordance with the regulatory framework. Both organisations, however, capitalise on the strong synergies through a system of referrals, special arrangements and cross selling in order to effectively provide a wide range of products and services under the ‘HDFC’ brand name.

As at March 31, 2020, advances of HDFC Bank stood at ` 9,93,703 crore – an increase of 21% over the previous year. Total deposits stood at ` 11,47,502 crore – an increase of 24%. As at March 31, 2020, HDFC Bank’s distribution network includes 5,416 banking outlets and 14,901 ATMs in 2,803 locations.

For the year ended March 31, 2020, HDFC Bank reported a profit after tax of ` 26,257 crore as against ` 21,078 crore in the previous year, representing an increase of 25%.

The shareholders of the bank, at its Annual General Meeting held on July 12, 2019 approved the sub-division (split) of one equity share of the bank from face value of ` 2 each into two equity shares of face value of ` 1 each.

HDFC together with its wholly owned subsidiaries, HDFC Investments Limited and HDFC Holdings Limited holds 21.2% of the equity share capital of HDFC Bank.

During the year, the Corporation received dividend of ` 864 crore from HDFC Bank. This included the special dividend received of ` 216 crore for the completion of 25 years of the bank.

In April 2020, the RBI directed banks not to make any further dividend payouts from the profits pertaining to the financial year ended March 31, 2020 until further instructions. The objective is for banks to conserve capital so as to ensure that they retain their capacity to support the economy and absorb losses brought on by the pandemic. The RBI indicated that the restriction on payment of dividend would be reassessed in September 2020. Consequently, HDFC Bank did not declare any dividend for the year ended March 31, 2020.

HDFC Life Insurance Company Limited (HDFC Life)

As at March 31, 2020, total premium income of HDFC Life stood at ` 32,707 crore as compared to ` 29,186 crore in the previous year, representing a growth of 12%. As at March 31, 2020, the company had a portfolio of 37 individual and 11 group products, along with 6 optional rider benefits, catering to a diverse range of customer needs.

The company has retained its number one position in total new business received premium with a market share of 21.5%, amongst private players. The company ranked third with market share of 14.2% based on individual weighted received premium and ranked first with a 29% market share based on group business (on received premium) during FY20.

HDFC Life has reported a standalone profit after tax of ` 1,295 crore for the year ended March 31, 2020 as against ` 1,277 crore in the previous year.

The new business margin based on actual expenses (post overrun) stood at 25.9% (PY: 24.6%).

As at March 31, 2020, the Indian Embedded Value stood at ` 20,650 crore (PY: ` 18,301 crore). The operating return on embedded value stood at 18.1%.

The solvency ratio of the company was 184% as at March 31, 2020 as against the minimum regulatory requirement of 150%.

The Corporation’s shareholding in HDFC Life stood at 51.4%.

HDFC Life did not pay interim dividend during the year.

In April 2020, owing to the uncertainties around COVID-19, Insurance Regulatoryand Development Authority of India (IRDAI) urged insurers to refrain from dividend pay-outs from profits pertaining to the financial year ended March 31, 2020.

HDFC Asset Management Company Limited (HDFC AMC)

HDFC AMC is one of India’s largest mutual fund managers. As at March 31, 2020, the quarterly average assets under management (QAAUM) stood at ` 3.7 lac crore compared to ` 3.4 lac crore in the previous year, registering a growth of 8%.

The ratio of equity oriented AUM and non-equity oriented AUM was 43:57. It has the largest actively managed equity mutual fund based on QAAUM, with market share at 15.2% as at March 31, 2020.

For the year ended March 31, 2020, the profit after tax stood at ` 1,262 crore as against ` 931 crore in the previous year, representing a growth of 36%.

HDFC AMC recommended a final dividend of ` 28 per equity share of ` 5 each compared to the total dividend of ` 24 per share paid in the previous year.

HDFC holds 52.7% of the equity share capital of HDFC AMC. During the year, the Corporation received dividend of ` 135 crore from HDFC AMC.

HDFC ERGO General Insurance Company Limited (HDFC ERGO)

HDFC ERGO continued to retain its market ranking as the third largest private sector player in the general insurance industry. The company had a market share of 8.8% (private sector) and 4.9% (overall) in terms of gross direct premium for the year ended March 31, 2020.

The company offers a complete range of insurance products like motor, health, travel, home and personal accident in the retail segment, customised products like property, marine, aviation and liability insurance in the corporate segment and crop insurance. The company had a balanced portfolio mix with the retail segment accounting for 58% of the business.

The gross written premium of HDFC ERGO for the year ended March 31, 2020 stood at ` 9,439 crore as against ` 8,722 crore in the previous year, representing a growth of 8%.

The combined ratio as at March 31, 2020 stood at 102.6%. The solvency ratio of the company was 189% as at March 31, 2020 as against the minimum regulatory requirement of 150%.

For the year ended March 31, 2020, profit after tax stood at ` 448 crore (PY: ` 383 crore).

HDFC ERGO did not pay any interim dividend during the year.

In April 2020, IRDAI urged insurers to refrain from paying from dividend pay-outs from profits pertaining to the financial year ended March 31, 2020.

HDFC holds 50.5% of the equity share capital of HDFC ERGO.

HDFC ERGO Health Insurance Limited (HDFC ERGO Health)

HDFC ERGO Health, (formerly Apollo Munich Health Insurance Company Limited) is a specialised health insurance company. During the year ended March 31, 2020, the gross written premium stood at ` 2,522 crore, representing a growth of 15% over the previous year.

The combined ratio as at March 31, 2020 stood at 112.1% compared to 99.8% in the previous year. The solvency ratio of the company was 174% as at March 31, 2020 as against the minimum regulatory requirement of 150%.

During the year ended March 31, 2020, the company reported a loss of ` 168 crore as compared to a profit of ` 11 crore in the previous year. The loss was on account of increased provisions on certain investments and overall slowdown in the business, including in the disruptions owing to the outbreak of COVID-19. Whilst renewal ratios were strong, there was also an increase in claims on matured policies.

The company became a subsidiary of the Corporation during the year. As at March 31, 2020, HDFC holds 51.2% of the equity share capital of HDFC ERGO Health.

HDFC Property Funds

HDFC Venture Capital Limited & HDFC Property Ventures Limited

HDFC Venture Capital Limited (HVCL) is investment manager to HDFC Property Fund, a registered venture capital fund with the Securities and Exchange Board of India (SEBI). HDFC Property Fund’s Scheme HDFC India Real Estate Fund, was launched in 2005 and had an initial corpus of ` 1,000 crore. The close-ended fund has been substantially exited and approximately 1.6 times the fund corpus has been returned to investors.

HDFC Property Ventures Limited (HPVL) prov ides investment advisory services to overseas asset management companies (AMCs). Such AMCs in turn manage and advise Indian and offshore private equity funds.

HDFC holds 80.5% of the equity share capital of HVCL and 100% of the equity share capital of HPVL.

The Corporation has sponsored two off shore funds – HIREF International LLC (‘HIREF’) and HIREF International Fund II Pte Ltd (‘HIREF II’).

HIREF was launched in 2007 and has a corpus of USD 800 million and includes USD 50 million of commitment by the Corporation. Exits have commenced and the fund is in the process of exiting the balance investments. The fund has made 14 investments in total, of which 8 investments have been fully exited at combined IRR of 15.6% (gross in ` terms). Till date, distribution, including partial and full exits of 1.3 times the fund corpus (in ` terms) has been made to the investors.

HIREF II had its final closing in April 2015 with a total corpus of USD 321 million which includes USD 40 million of commitment by the Corporation. The fund has made 10 investments of which 3 investments have been fully exited at combined IRR of 22.1% (gross in ` terms). Till date distribution, including partial and full exits, of 0.5 times the fund corpus (in ` terms) has been made to the investors.

HDFC Ventures Trustee Company Limited has entered into a trust deed to act as a trustee to “HDFC India Real Estate Fund III” (‘HIREF III’) which is registered under SEBI (Alternative Investment Funds) Regulations, 2012 (“AIF Regulations”). HIREF III is in the process of raising INR equivalent of USD 500 million for making investments in accordance with AIF Regulations and the fund documents.

HDFC Capital Advisors Limited

HDFC Capital Advisors Limited is in the business of providing investment management services for real estate private equity financing. The company’s primary objective is to provide long-term equity and mezzanine capital to developers at the land and pre-approval stage for the development of affordable and mid-income housing in India. The company is the investment manager to HDFC Capital Affordable Real Estate Fund 1 (H-CARE 1) and HDFC Capital Affordable Real Estate Fund 2 (H-CARE 2), which are registered with SEBI as Category II Alternative Investment Funds.

H-CARE 1 was raised in 2016 with a fund size of USD 450 million. H-CARE 2 has a fund size of US$ 650 million and achieved its final closure in October 2018. H-CARE 1 and H-CARE 2 combine to create a large platform targeting the development of affordable and mid-income housing. Currently, approximately US$ 1 billion of investments is committed with leading developers across India in the affordable and mid-income housing space. The platform is expected to support the development of approximately 75 residential projects and 1.7 lac residential units in urban India.

HDFC Capital Advisors Limited has recently launched the HDFC Affordable Real Estate and Technology Program (H@ART), a first-of-its-kind initiative aimed at creating efficiencies and lowering costs in each part of the development cycle for a real estate project. H@ART seeks to mentor, partner and invest in real estate technology companies that drive innovation and efficiencies within the affordable housing ecosystem.

HDFC Capital Advisors’ target is to finance the development of one million affordable homes in India while sustainably addressing the needs of the affordable housing ecosystem through a combination of innovative financing, partnerships and technology. In order to achieve this objective, the company is in active discussions with leading global investors to raise additional funds to be invested across the affordable housing ecosystem.

HDFC Capital Advisors Limited is a wholly owned subsidiary of the Corporation.

HDFC Sales Private Limited (HSPL)

HSPL continues to strengthen the Corporation’s marketing and sales efforts by providing a dedicated sales force to sell home loans and other financial products.

HSPL has a presence in 206 locations. During the year under review, HSPL sourced loans accounting for 54% of individual loans disbursed by HDFC.

HSPL is a wholly owned subsidiary of the Corporation.

HDFC Credila Financial Services Private Limited (HDFC Credila)

HDFC Credila is India’s first dedicated education loan company, providing loans to students pursuing higher education in India and abroad. As at March 31, 2020, HDFC Credila had cumulatively disbursed ` 10,477 crore to over 62,600 customers. The outstanding loan book stood at ` 6,257 crore, registering a growth of 17% over the previous year. The average loan amount disbursed during the year was ` 22.7 lac.

For the year ended March 31, 2020, HDFC Credila reported a profit after tax of ` 123 crore as against ` 102 crore in the previous year, representing a growth of 21%.

As at March 31, 2020, the capital adequacy ratio stood at 22.3% and Tier 1 capital stood at 14.7%.

In addition to having its own offices and sourcing applications through the web, HDFC Credila capitalises on HDFC Group’s distribution network to source and market education loans.

HDFC Credila’s borrowers are entitled to income tax exemption under Section 80E of the Income Tax Act, 1961.

HDFC Credila is a wholly-owned subsidiary of the Corporation.

HDFC Education and Development Services Private Limited (HDFC Edu)

HDFC Edu is the Corporation’s wholly owned subsidiary which focuses on the education sector.

The objective of HDFC Edu entering the education space is to imbibe best practices in education and facilitate innovation, thereby creating a visible impact on the education system in the country.

The company provides services to The HDFC Schools which are located in Gurugram, Pune and Bengaluru. These schools follow the National Curriculum Framework, 2005 and are affiliated with the Central Board of Secondary Education.

The HDFC Schools believe in inclusive education and cater to children with special needs with trained teachers to take care of them. The schools also have children from underprivileged backgrounds. The schools now have more than 2,000 students and have created employment for more than 500 people.

AUDITED CONSOLIDATED ACCOUNTS

Whilst Indian Accounting Standards (Ind AS) has been made applicable for NBFCs, including housing finance companies from the accounting period beginning April 1, 2018, the same is still pending for adoption by banks and insurance companies.

The consolidated financial statements comprise the standalone financial statements of the Corporation together with its subsidiaries which are consolidated on a line-by-line basis and its associates which are accounted on the equity method.

On a consolidated basis for the year ended March 31, 2020, the profit before tax was ` 26,193 crore as compared to ` 22,099 crore in the previous year representing a growth of 19%.

Af ter providing ` 3,367 crore (PY: ` 4,518 crore) for tax, the profit after tax before OCI stood at ` 22,826 crore as compared to ` 17,581 crore in the previous year, representing a growth of 30%.

The total comprehensive income stood at ` 16,613 crore as compared to ` 17,662 crore in the previous year.

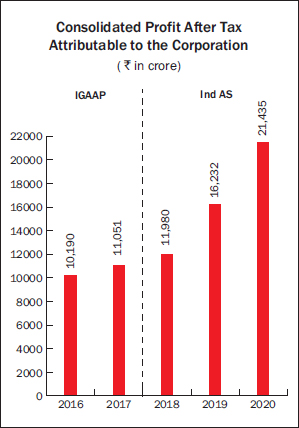

The profit attributable to the Corporation was ` 21,435 crore as compared to ` 16,232 crore, representing a growth of 32%.

The post-tax return on assets for the consolidated group accounts for the year ended March 31, 2020 was 3.3%. The return on equity stood at 18.1%. The basic and diluted earnings per share (on a face value of ` 2 per share) for the group was ` 124.1 and ` 123.2 respectively.